Canopy Growth Corporation (CGC) has emerged as a key player in the rapidly evolving cannabis industry, captivating the attention of investors and enthusiasts alike. With its roots dating back to 2013, the company has navigated through regulatory challenges and market dynamics, positioning itself as a frontrunner in the global cannabis market. This article delves into the history, growth, and future prospects of CGC stock.

The Genesis:

Founded by Bruce Linton and Chuck Rifici, Canopy Growth Corporation began as Tweed Marijuana Inc. in 2013, becoming the first publicly traded cannabis company in North America. The company’s initial focus was on the medical marijuana market in Canada, leveraging the changing regulatory landscape that paved the way for legalized medical cannabis.

Transformation and Expansion:

Canopy Growth’s transformative moment came in 2015 when it merged with Bedrocan Cannabis Corp., forming a robust entity with increased production capabilities. The company went public on the Toronto Stock Exchange (TSX) under the ticker symbol CGC. The strategic move positioned Canopy Growth as a leader in the cannabis industry, attracting significant investments and laying the foundation for its global expansion.

In 2018, the legalization of recreational cannabis in Canada marked a pivotal moment for Canopy Growth and the industry at large. The company seized the opportunity, expanding its product line and market presence. With an impressive portfolio of brands, including Tweed, Spectrum Therapeutics, and more, CGC aimed to capture a diverse consumer base, solidifying its status as a cannabis industry giant.

Key Partnerships and Investments:

One of Canopy Growth’s strengths lies in its strategic partnerships and investments. In 2017, the company secured a game-changing investment from Constellation Brands, a major player in the beverage alcohol industry. This partnership infused Canopy Growth with significant capital and expertise, enabling it to explore the potential of cannabis-infused beverages and expand its global footprint.

International Expansion:

Recognizing the global potential of the cannabis market, Canopy Growth set its sights on international expansion. The acquisition of Storz & Bickel, a German vaporizer company, and the establishment of operations in numerous countries positioned CGC as a truly global player. The company’s presence extended to Europe, Latin America, and beyond, creating a diversified revenue stream and reducing dependence on any single market.

Challenges and Adjustments:

Despite its successes, Canopy Growth faced challenges that impacted its stock performance. Leadership changes, regulatory hurdles, and slower-than-expected market growth led to fluctuations in CGC stock prices. The cannabis industry’s evolving landscape, coupled with changing consumer preferences, required Canopy Growth to adapt its strategies to stay competitive.

In 2019, Bruce Linton, the co-founder and then-CEO, parted ways with the company. This departure marked a turning point for Canopy Growth, prompting a reassessment of its business model and operations. Under new leadership, the company focused on cost-cutting measures and operational efficiency to streamline its path to profitability.

Recent Developments:

As of the most recent available information, Canopy Growth has continued to make strategic moves to strengthen its position in the cannabis market. The introduction of innovative products, partnerships with celebrities, and ongoing research and development initiatives demonstrate the company’s commitment to staying at the forefront of industry trends.

The legalization of cannabis in various U.S. states and the potential for federal legalization have fueled optimism in the market. Canopy Growth, like other cannabis companies, eyes the vast opportunities in the U.S. market, anticipating a significant boost in revenue and market capitalization if federal regulations evolve favorably.

Investor Considerations:

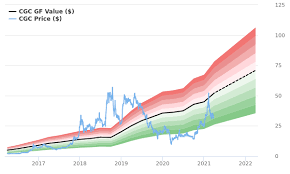

Investors eyeing CGC stock should carefully evaluate the ever-changing landscape of the cannabis industry. Regulatory developments, market trends, and the competitive environment can influence the stock’s performance. Canopy Growth’s international diversification, strategic partnerships, and product innovation are factors that could contribute to its growth.

It’s crucial for investors to stay informed about the company’s financial health, product pipeline, and global expansion plans. Additionally, monitoring the regulatory environment, especially in key markets like the U.S. and Canada, will provide insights into the potential trajectory of CGC stock.

Conclusion:

Canopy Growth Corporation’s journey in the cannabis industry reflects the dynamic nature of this burgeoning market. From its humble beginnings as Tweed Marijuana Inc. to becoming a global cannabis powerhouse, CGC has navigated challenges and capitalized on opportunities.

While the cannabis industry’s future remains uncertain, Canopy Growth’s strategic positioning, international footprint, and ongoing innovation efforts suggest a commitment to long-term success. Investors should approach CGC stock with a comprehensive understanding of the industry dynamics and a keen eye on the company’s strategic moves in this ever-evolving market.